(Originally published on AlleyWatch)

By Kyle LaBossiere

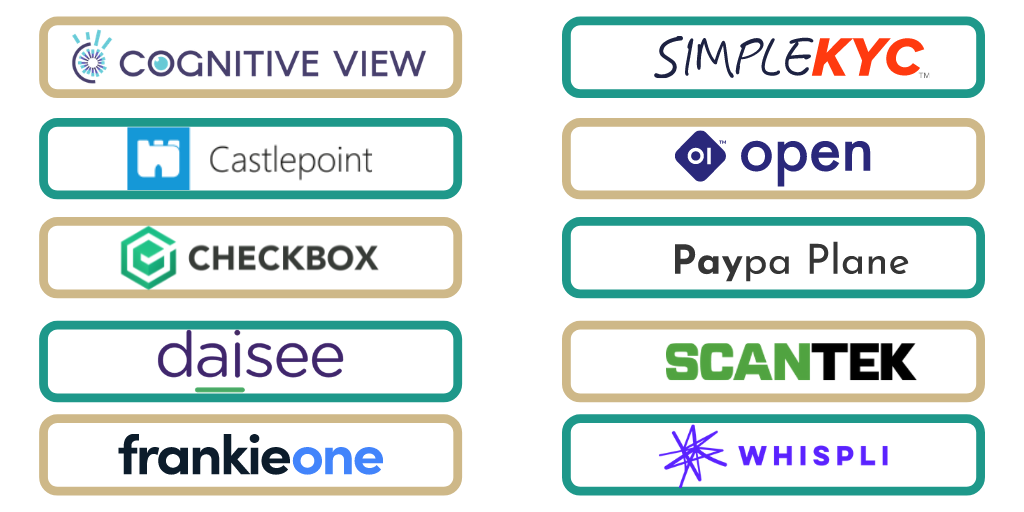

We’re excited to showcase the startups in our inaugural Australian Program— in partnership with Austrade, the Australian Trade & Investment Commission!

There are over 800 Fintech companies in Australia tackling the challenges of the $196B domestic financial services industry. Australia has the 8th largest pool of managed funds in the world and its major four banks consistently rank amongst the world’s most profitable. The wealthy island nation is a fertile ground for innovation from within, with the nation’s populace serving as an engaged group of early technology adopters, which has led to great success for Fintech, Regtech, Insurtech, and Big Data startups.

We’re thrilled to welcome these ten FinTech companies to our program and help them with their international expansion into the US market. Sign up to be a part of our Demo Day here!

Castlepoint Systems

Founded by Rachael Greaves in 2016, Castlepoint Systems is a data and records management platform built for the enterprise with a focus on compliance, security, and discovery. Organizations can catalog their entire infrastructure across multiple locations including cloud locations like Dropbox, 365, and AWS, databases, and proprietary systems using artificial intelligence. Castlepoint can then be used to manage and control the data irrespective of location. The platform’s intelligence engine automates the classification of the data, applying configurable rules-based logic to ensure regulatory compliance, at scale.

Checkbox

Founded by Evan Wong and James Han in 2016, Checkbox is a no-code and automation platform that allows organizations to build workflow solutions using intuitive drag and drop functionality. Users can design streamlined self-service tools with smart decision-based intake workflows that are fully compliant with audit trails, transcripts, documentation, and approval processes. By eliminating the dependency on IT teams, finance professionals can quickly deploy specific, powerful workflows to solve business needs without having to worry about tax, audit, regulatory, and legal concerns, which can bog down time-to-market in financial services. The platform offers a number of pre-loaded templates for common uses such as expense management, billing, compensation, trusts, risk management, and payables.

Checkbox raised $1.8M in an angel round in 2018.

Cognitive View

Founded by Dilip Mohapatra in 2018, Cognitive View is a platform that analyzes all customer communication data to ensure that all compliance requirements are being met. As a result of the shift to remote, with customer interactions happening across a variety of channels, organizations are able to leverage Cognitive View to automate compliance monitoring and conduct risk management. Using AI and NLP to analyze every conversation in real-time, the platform is also used to improve customer experience by managing complaints, retention, quality of customer interactions, and more.

Daisee

Founded by Richard Kimber in 2017, Daisee is an AI-powered speech analytics platform that helps organizations understand customer sentiment during any voice interaction. The platform converts voice to text and then leverages AI and NLP to analyze, categorize, and score every conversation. The scoring framework is derived from a robust semantic engine that has identified the most meaningful phrases that convey information about customer intent and is flexible enough to be programmable for custom use-cases. Daisee integrates with leading call center software platforms and is used by organizations to understand not only to measure current customer experience efforts holistically but also to identify trends and signals based on customer speech.

Daisee has raised A$8.8M (~$6.84M USD) from investors that include Alium Capital, Thorney Investments, and a number of private investors.

FrankieOne

Founded by Simon Costello and Aaron Chipper in 2017, FrankieOne is an onboarding and fraud detection solution that’s billed as infrastructure-as-a-service. KYC and AML requirements typically require financial institutions to rely on numerous third-party data providers for both onboarding and ongoing monitoring. FrankieOne streamlines this process into a single API and robust dashboard that integrates 300+ different data providers, mitigating the chance of fraud and security vulnerabilities. Digitally-focused financial institutions (neo-banks, fintech startups, global banks, and platform banks) can now deliver real-time, risk-based decisioning combined with fast, customer-friendly experiences.

FrankieOne has raised A$3M ($USD) in a round led by Tidal Ventures in 2020.

Open

Founded by Jason Wilby and Jonathan Buck in 2016, Open is an insurtech infrastructure platform that lets insurance companies and brokers manage their car, home, and travel insurance businesses online from quote to claim. The white-label platform lets these insurance businesses offload critical functions such as licensing, underwriting, claims, servicing, pricing, consumer apps, and payments while maintaining a cohesive customer and brand experience, resulting in access to new channels, growth in profitability, and reduction in churn for Open’s customers.

Open also operates Huddle, a consumer insurance company in Australia that has over 60,000 customers. Since its founding, Open has raised a total of $23.7M and is backed by investors that include AirTree Ventures, Alium Capital, Seven West Media, Hollard Insurance, and Richard Enthoven.

Paypa Plane

Founded by Simone Joyce and Jonathan Grant in 2017, Paypa Plane is a payment infrastructure platform for recurring payments. The company’s white-label solution layers on top of a financial institution or SME’s existing payment stack to offer a modern payment solution that works with both traditional payments (credit, debit, ACH) and emerging digital currencies (crypto). Banks and businesses seamlessly ensure collection, compliance, and cash flow through automation while payors are now able to manage their many subscriptions in a central, secure location, reducing the chance of late fees and missed payments.

Scantek

Founded by Ches Rafferty and Neil Bamber in 2012, Scantek is a real-time identity verification solution that uses ID processing, document verification, and facial biometric authentication. The platform can be used for verification in-person or online, making it versatile enough to be used in banking, retail, real estate, telecommunications, automotive, gaming, hospitality, and entertainment. All customer data is secure and never in the hands of a human while meeting all KYC and AML requirements. Scantek currently supports over 1200 global identification types.

Simple KYC

Founded by Brandon Bates and Eric Frost in 2015, Simple KYC is a cloud-based end-to-end platform to help organizations meet and manage know-your-customer (KYC) requirements. KYC requires financial institutions to verify the identity, suitability, and risk involved with a business relationship and this process can be cumbersome to do for organizations that have complex structures. The platform allows banks and financial institutions to automate the diligence needed to meet the threshold for satisfying KYC, allowing them to deliver faster transactions for their customers, often in less than a few hours. Simple KYC consolidates and streamlines both the onboarding process and ongoing customer management to meet ever-changing regulatory requirements, leaving institutions protected with detailed audit trails.

Whispli

Founded by Sylvain Mansotte and Sacha Schmitz in 2014, Whispli is an anonymous, encrypted, platform for companies to engage with their employees. The company has built an award-winning whistle-blowing and case management platform, Core, that lets organizations provide the resources to empower employees to report and respond to malfeasance in a compliant manner. The company’s newest product, Pulse, is an anonymous surveying tool that lets employers collect feedback and respond to employee concerns to improve HR, compliance, or culture. Pulse boosts employee engagement by 300% and employee satisfaction by 60% as compared to static surveying tools.

Whispli has raised a total of $2.8M in funding and is backed by UP2398, AirTree Ventures, Blackbird, Liquid Fund, Pioneer Fund, and Louis Beryl. The company completed Y-Combinator in the summer of 2018.

Be a part of our Demo Day and hear what these 10 growing Australian FinTech companies have to say! Sign up here.